9-30-2025

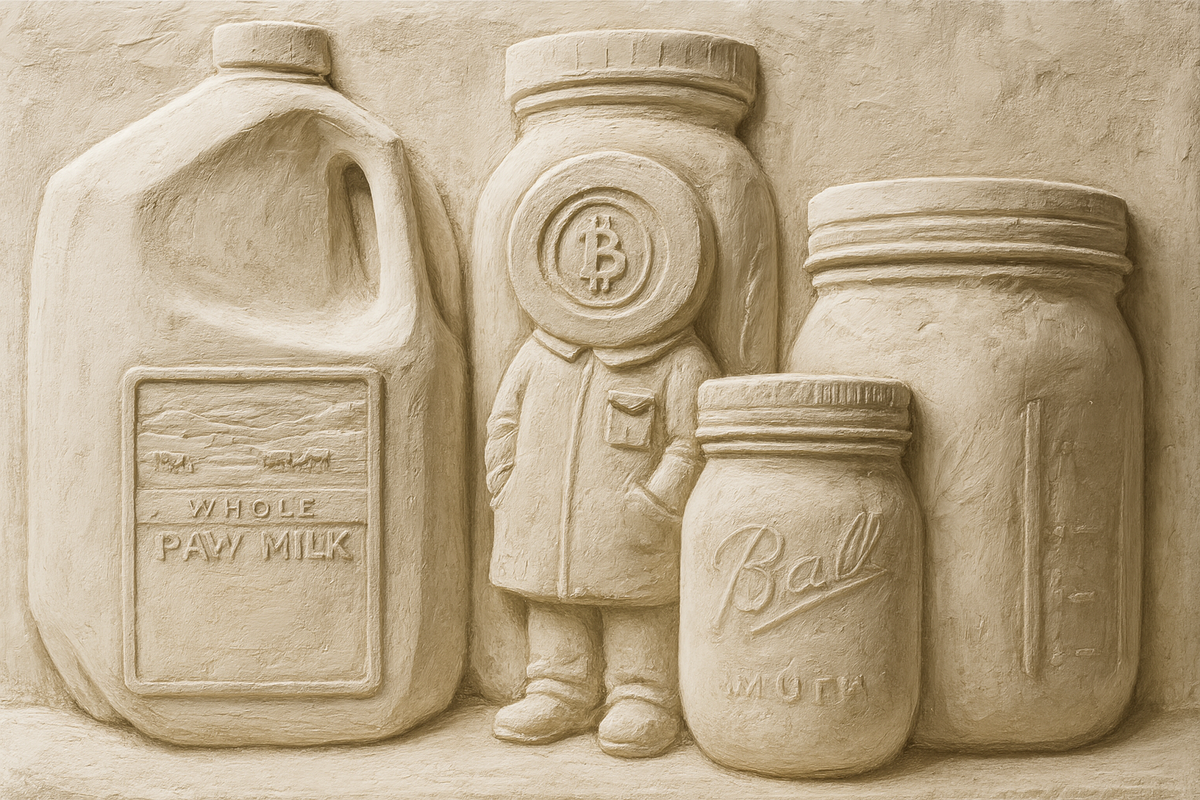

Episode 1179 features dairyman JR Burdick on his shift from commercial dairy to regenerative raw milk sales, the damage fiat money has done to farming, ranchers as ecologists, fragility in U.S. food systems, and Bitcoin’s role in building food sovereignty.

JR Burdick’s story is a window into what happens when farming collides with fiat money. For decades, he ran a commercial dairy in Iowa and Missouri, milking cows twice a day and selling into the cooperative system. That model collapsed in 2022 when he refused to sign new paperwork filled with climate and compliance language. The co-op stopped picking up his milk. Overnight, his market disappeared. Rather than fold, he and his wife cut their herd to fifteen cows and pivoted to direct-to-consumer raw milk sales. They bottle their own product, deliver weekly, and face challenges with marketing, shelf life, and convenience. It is farming the way his grandfather did, with a twenty-first-century peer-to-peer twist.

The deeper issue is the money. JR makes it clear that land prices, input costs, subsidies, and futures markets are all distorted by fiat. Since 1971, when the dollar lost its gold backing, agriculture has been on a treadmill. Land is valued as an inflation hedge, not as a productive base. Farmers borrow against inflated land values, chasing efficiency with more equipment, bigger barns, and confinement systems. When Paul Volcker began raising rates in 1979, variable-interest loans exploded and the farm crisis hit. Today, the same fragile leverage haunts the industry. Land is priced for speculation, not production, and "subsidies" keep the game alive.

Against that backdrop, ranchers as ecologists emerge as the real innovators. JR has shifted his view of efficiency from dollar yield per acre to ecological balance. Animals grazing in rotation, chickens cleaning up behind cows, and soil life regenerating is where resilience builds. The rancher becomes the ecologist, managing sun, soil, and water instead of just pouring inputs into dirt. Commodity agriculture tries to engineer sameness, but regenerative systems invite diversity, nuance, and genuine health. It is slower, less predictable, but it connects food back to place.

Yet the U.S. food system sits on a knife’s edge. Consolidation has left four major meatpackers controlling the industry. Imports fill gaps when domestic herds are culled. Ethanol mandates warped crop insurance models ultimately gutting cattle herds. COVID exposed fragility in processing plants. One disruption like fuel price spikes, geopolitical breakdown, or transport bottlenecks, could ripple through the entire supply. Meanwhile, food quality has slipped into empty calories, feeding a sick-care economy rather than nourishing people. The push toward fake meat and factory proteins is a technocratic attempt to control what nature was already doing well.

Bitcoin enters here as both a tool and a frustration. JR is a Bitcoiner, buying regularly and eager to transact with customers. But very few will pay him in Bitcoin. The parallel is striking: just as people avoid the inconvenience of meeting their farmer or shaking their rancher's hand they avoid the unfamiliarity of paying with sound money. Both require proof of work, both require responsibility. Bitcoin is a peer-to-peer bridge out of a broken system. If consumers step forward, sovereignty in both food and money becomes possible. We have a lot of work to do and time is running out.

Shake your Daryman's hand: https://x.com/JRcowfarmer

Member discussion: