9-8-2025

The Clarity Act might retroactively bail out devs. Nasdaq wants stocks on-chain. Saylor dilutes shareholders to stack more Bitcoin. Node wars drag on. Solo miner wins a $350K block against all odds.

A new draft of the Clarity Act dropped, and it’s got some teeth. If passed with the current language, it wouldn’t just protect developers from future liability it would reach back in time to afford "retroactive protection". That could mean Roman Storm walks free, because he didn’t take a plea deal. The Samurai Wallet guys did. One gambled and lost, one folded. And that’s a big deal because now we’re staring down the barrel of precedent that could start leaking into AI dev, ChatGPT-written code, you name it. If you’re building software, this affects you whether you think you're in Bitcoin or not.

Meanwhile, Nasdaq wants tokenized stocks. They filed a rule change with the SEC so they can start listing equities on the blockchain. But they’re not talking bananas-on-the-blockchain style idiocy. This is somewhat legit. Stocks work as data, kind of, so tokenizing those makes way more sense than trying to slap a QR code on a banana. The endgame here is obvious: 24/7 markets. Full-time trading. Everything becomes real-time and always-on. And that means nobody sleeps. If you thought derivatives traders looked rough before, just wait till they’re chasing Tesla tokens at 3AM on a Sunday.

And now we get to Strategy. Michael Saylor’s firm bought another $217 million in Bitcoin, but not before diluting shareholders by 591,000 shares. Why’s that a problem? Because they had a rule (an internal one) that said they wouldn’t do that unless MNAV remained above 2.5. It didn’t. They did it anyway. And I think that’s why they got passed over for S&P 500 inclusion. Institutions like stability. Changing your rules months after setting them? That’s not exactly stable. In other news, NYDIG’s out with a warning that these Bitcoin treasury companies might be in for a rough ride, especially the ones copy-pasting Saylor’s playbook without bringing anything new to the table.

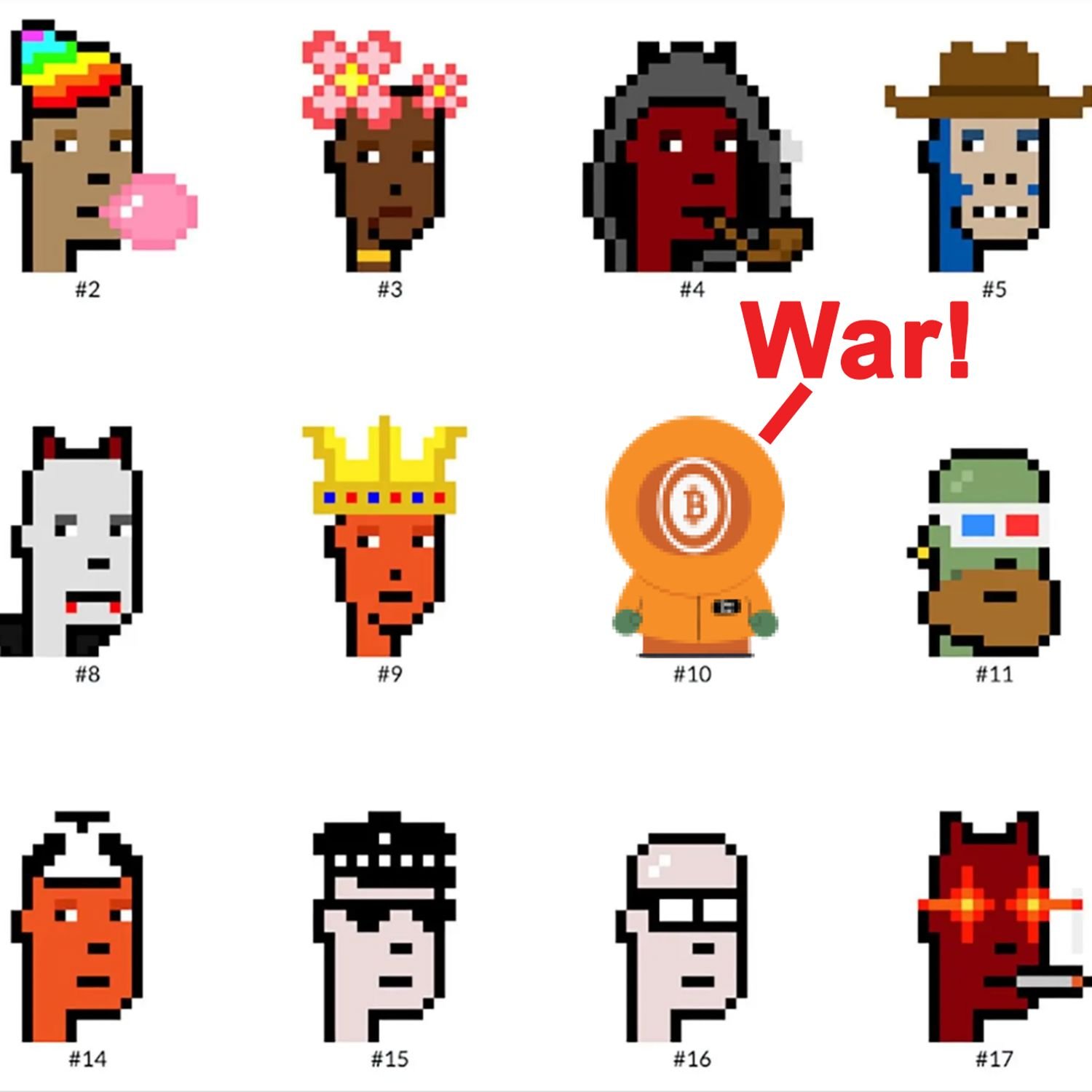

Now, let’s talk about the node wars. Core vs. Knots. I’m muting the whole thing. It’s getting ugly. One side’s threatening to fork Core over fears that ordinals and runes might get censored. The Ordinals guys are saying Core might renig on increasing the OP_RETURN limits because of the fight with the Knots guys except there’s no real indication Core’s even thinking about that. I think the Ordinal guy is just throwing gas on the fire. Maybe trying to keep ordinal hype alive. Honestly, I’m over it. This isn’t the fork wars of 2017. It could get worse, sure. But right now? Just noise.

But you know what’s not noise? A solo miner pulled off a unicorn. 200 terahashes. One block. $350,000. That’s a one-in-a-hundred-year event, statistically speaking. And it happened. While fees sit at decade lows and difficulty hits all-time highs, someone out there still won. ASICs are gonna get cheaper. They’ll start heating homes, hot tubs, maybe greenhouses. Commoditization’s coming. And when it does, you’re gonna see mining spread out again. Maybe that’s how it was always supposed to be.

Circle P Vendor: Peony Lane Vinyards

Naked wine. No additives. Colorado-grown.

Pay in Bitcoin and tell @BenJustman the plebs sent you with code "BitcoinAnd".

[Product Picture]

Member discussion: