9-4-2025

Coinbase accelerates AI in production code; El Salvador Government's Bitcoin Conference announced; a Trump-backed miner lists and leans into a treasury model; US Bank revives institutional custody; hashrate prints records; the ECB tightens its gaze on stablecoins.

El Salvador’s upcoming Bitcoin Historico conference marks a milestone not only for the country but for Bitcoin globally. As the world’s first government-sponsored Bitcoin conference, it transforms San Salvador’s historic district into a multi-venue celebration of finance, culture, and technology. The event places Bitcoin inside national institutions like the Palace and Library while filling the streets with energy, symbolizing how the protocol is no longer confined to code or markets but woven into civic life. Attendees will hear from familiar industry leaders, but the greater significance lies in seeing a nation fuse monetary sovereignty with cultural identity in a public festival format.

Coinbase’s leadership now wants AI to write roughly half of the exchange’s code by October. Management already tracks AI-generated lines and expects engineers to integrate tools like Copilot across workflows. That stance may accelerate refactors and greenfield builds, yet it also introduces social and operational risk. The real test arrives on high-volume market days when Coinbase’s back end faces stress. If incident rates rise, the cost of speed will reveal itself quickly.

A newly listed miner, American Bitcoin, combines production with an explicit balance-sheet strategy. Backed by Donald Trump Jr. and Eric Trump and merged with Gryphon Digital Mining, the company opened on Nasdaq and promptly filed to sell additional shares. The playbook resembles a treasury model: mine coins, hold coins, and leverage that stack through capital markets to grow the stack further. MicroStrategy proved capital markets can chase Bitcoin exposure. A miner-treasury hybrid extends that idea with self-sourced supply and public funding flexibility. Execution discipline around dilution, preferreds, and issuance windows will determine whether this model compounds or stalls.

Institutional plumbing keeps advancing. U.S. Bank has relaunched Bitcoin custody for fund managers and now supports custody for spot ETFs, with NYDIG acting as sub-custodian. Clearer frameworks reduce operational hesitation, and large administrators can package custody, fund accounting, and ETF services under one roof. For managers, that reduces integration friction and broadens mandate design, especially when pairing ETF workflows with balance-sheet Bitcoin or SMA overlays.

On chain, miners continue to scale. The network’s single-day hashrate punched into the zettahash range before settling back below one ZH/s. Price action stayed quiet, so the simpler explanation fits: delayed hardware finally reached racks, power, and pools. Customs backlogs and logistics bottlenecks resolve in lumpy, visible bursts. That adds security budget in raw hashes, increases competition for block rewards, and pressures high-cost fleets to optimize or exit.

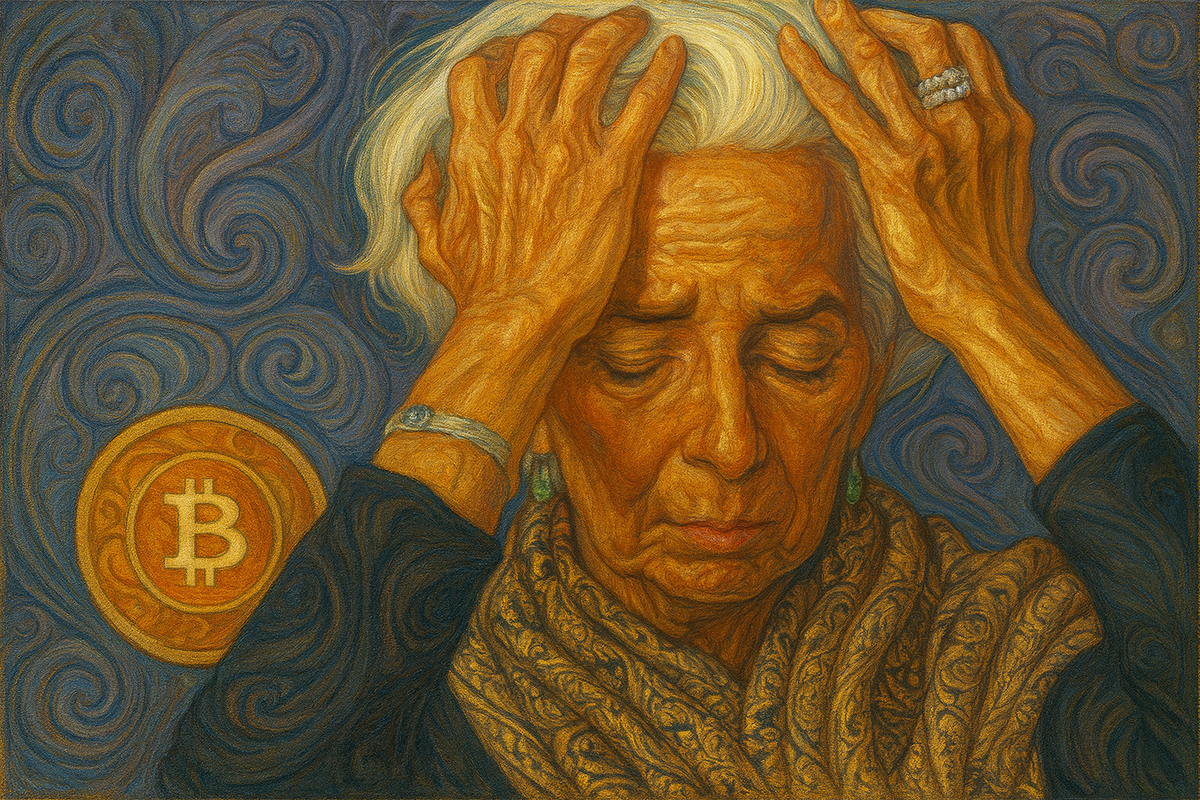

Policymakers, meanwhile, keep staring at stablecoins. ECB President Christine Lagarde urged action on non-EU issuers and joint issuance structures that fall outside Europe’s MiCA regime. The subtext reads like concern over redemption mechanics and euro liquidity during stress. If savers prefer jurisdictions with stronger safeguards, deposits and data follow those rails. Europe can accelerate a digital euro, tighten equivalence tests, or both. Markets will price the credibility of each step long before politicians finish their speeches.

Circle P Vendor: Oshi

Member discussion: