8-25-2025

Citibank fears stablecoin yields may drain deposits. Corporations gamble on Solana treasuries. Japan proposes a 20% crypto tax and regulated stablecoin. Aqstr.com launches sat-based engagement. A Bitcoiner loses 783 BTC to social engineering.

Citibank kicked the week off with yummy, yummy FEAR! They’re warning that stablecoin yields could drain deposits from the banking system, just like money market funds did in the late seventies and early eighties. Back then, savers ran to higher-yield vehicles while banks sat on capped rates and watched deposits flee. The exact same thing could happen again, only this time the vehicle isn’t a money market fund. It’s dollar-pegged stablecoins that can pay interest. The bankers know it, and they’re already nervous. Nervous bankers mean more consolidation ahead, and that’s the last thing we need. We’ve watched waves of consolidation for a century: the Depression, the S&L crisis, 9/11, 2008, and COVID. Every one of them shrank the number of banks in the system. Stablecoins could be the next trigger.

On the corporate side, things aren’t looking much smarter. We started with companies stacking Bitcoin. MicroStrategy, Meta Planet, and a few others. At least those plays carried conviction. But now? We’re watching listed firms raise hundreds of millions of dollars to buy Solana and other suit-branded garbage. Sharps Technology pulled in $400 million for a Solana treasury and saw its stock pop seventy percent. It's a stupid day in clown world. Executives in suits are repeating the same mistakes as street-level retail traders in 2017. It’s corporate shitcoinery, plain and simple, and it’s coming dressed up in SEC filings and press releases. The boardroom has joined the dumpster fire.

Meanwhile, Japan is reshaping its tax code. Right now, Japanese investors pay progressive rates on crypto gains that can reach fifty-five percent. The new proposal sets a flat twenty percent tax and treats digital assets like listed stocks. That could be a break for Japanese traders. On top of that, regulators are preparing the launch of JPYC, a regulated yen-backed stablecoin worth a trillion yen over the next three years. Japan is making moves to compete in the global digital asset space, even as its bankers surely sit and sweat over what stablecoin yields will do to their own deposits.

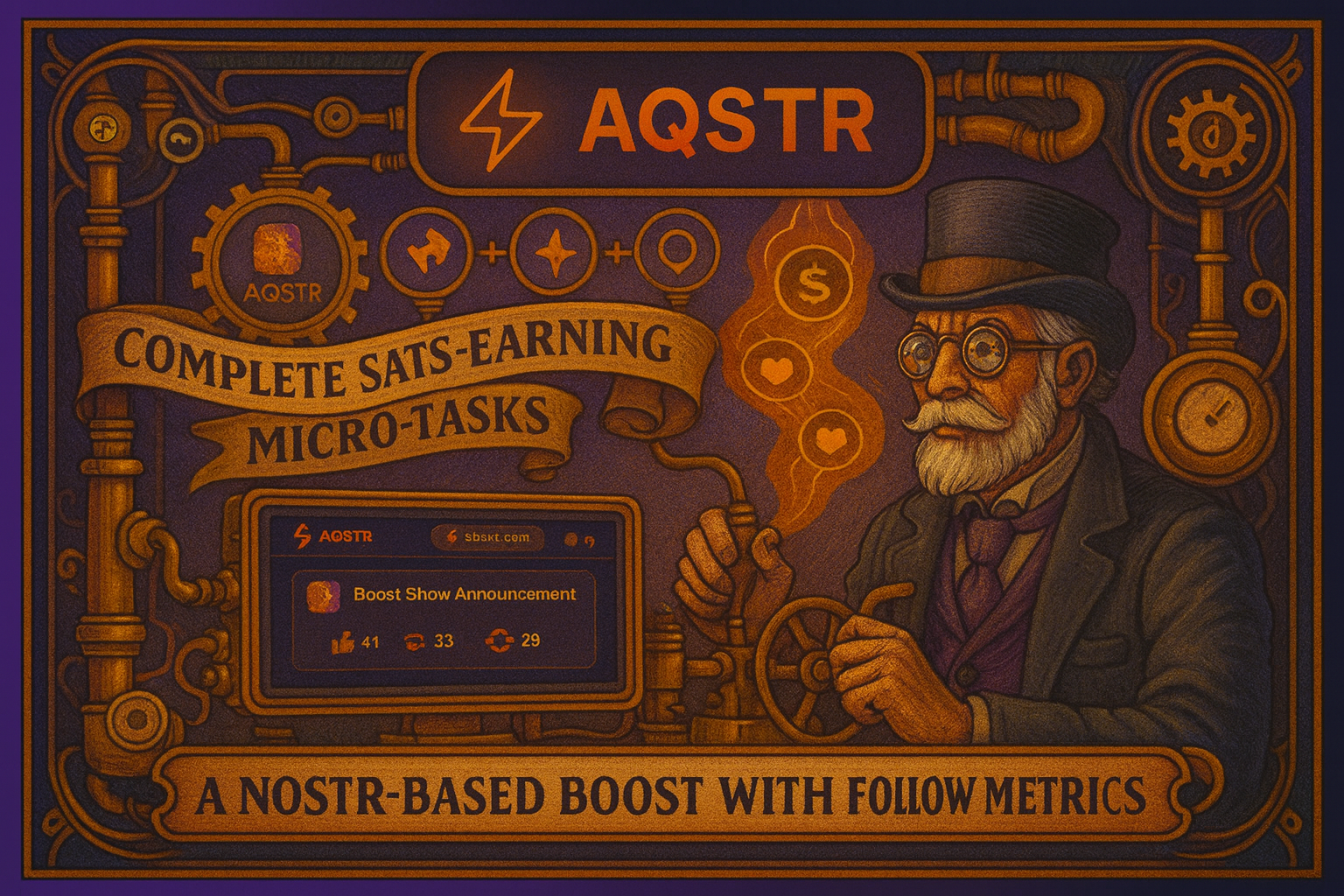

In the middle of all this, new tools keep appearing. One that caught my eye is aqstr.com, a Nostr-based service where you can create little campaigns that pay sats for likes, reposts, replies, and follows. I tested it myself with a show announcement and watched activity spike. Thirty-three reposts, forty-one likes, nearly thirty replies. Numbers I nomally don't see for simple show announcements. And I spent less than the cost of a Starbucks coffee. Call it zapvertising if you want, but it works. If it gains traction, who knows where it goes. Incentivized micro-tasks for sats could spread far beyond boosting posts.

A Bitcoiner lost 783 BTC (ninety million dollars) to a social engineering scam. The thieves hacked trust. By impersonating exchange and wallet support staff, they convinced the victim to hand over details that should never be shared. Within minutes, the Bitcoin was gone. That’s the nightmare. Nobody credible will ever ask for your seed phrase. Ever. If they do, it’s a scam. Stay sharp, because one mistake can cost everything.

Circle P Vendor of the Day: SoapMiner

Grass‑fed beef tallow soap, handmade in small batches and he only accepts Bitcoin! Use code BITCOINAND for 10% 0ff.

Member discussion: